Third Party Risk Management Market Growth Drivers & Forecast | 2035

In the exceptionally dynamic, data-driven, and high-stakes environment of the global Third-Party Risk Management (TPRM) market, the practice of conducting a rigorous, methodical, and continuous competitive analysis is not merely a beneficial exercise; it is an indispensable and foundational discipline for strategic planning and long-term market relevance. The competitive landscape is in a perpetual state of transformation, with new risk intelligence sources constantly emerging, major M&A deals frequently redrawing alliances, and regulatory requirements continually evolving. A static, point-in-time snapshot of competitors, therefore, becomes obsolete almost as soon as it is completed. What is fundamentally required is a living, breathing framework—a continuous process for systematically monitoring, analyzing, and anticipating competitors' moves and market positions. A formal Third-Party Risk Management Market Competitive Analysis provides the structured intelligence necessary to navigate these complexities and make agile, data-driven decisions.

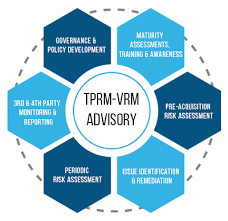

A truly robust and actionable competitive analysis framework for the TPRM market must extend far beyond a superficial, check-box comparison of product features. While a feature matrix covering core capabilities like questionnaire management and workflow automation is a useful starting point, a deeper analysis requires evaluating competitors across a much broader set of critical criteria. This includes a thorough deconstruction of the breadth, depth, and quality of their risk intelligence data sources. It is essential to understand not just what risks they cover (cyber, financial, ESG, etc.), but also how they collect, validate, and update that data. Another critical axis of analysis is the sophistication of their platform's automation and analytics capabilities, including their use of AI and machine learning for risk scoring and correlation. A comprehensive analysis must also scrutinize their business models, including pricing (per-vendor vs. tiered subscription), the strength of their partner ecosystems, and their target customer segments (enterprise vs. SME).

The ultimate purpose of this disciplined and continuous analytical process is to clearly identify, articulate, and then relentlessly fortify a company's own unique, defensible, and sustainable competitive advantage. By systematically mapping the entire competitive landscape—understanding not just what competitors do, but how and why they do it—a firm can accurately pinpoint strategic gaps in the market, identify areas where established players may be vulnerable (such as with a poor user experience or a lack of coverage for a specific risk domain), and uncover critical, unmet customer needs that represent fertile ground for innovation. The Third-Party Risk Management Market size is projected to grow USD 10.5 Billion by 2035, exhibiting a CAGR of 6.22% during the forecast period 2025 - 2035. The insights derived from this analysis must be translated directly into concrete, strategic actions that guide the business, allowing for more confident decision-making on where to allocate precious R&D resources and how to craft a compelling marketing narrative that highlights a unique value proposition.

Top Trending Reports -

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness